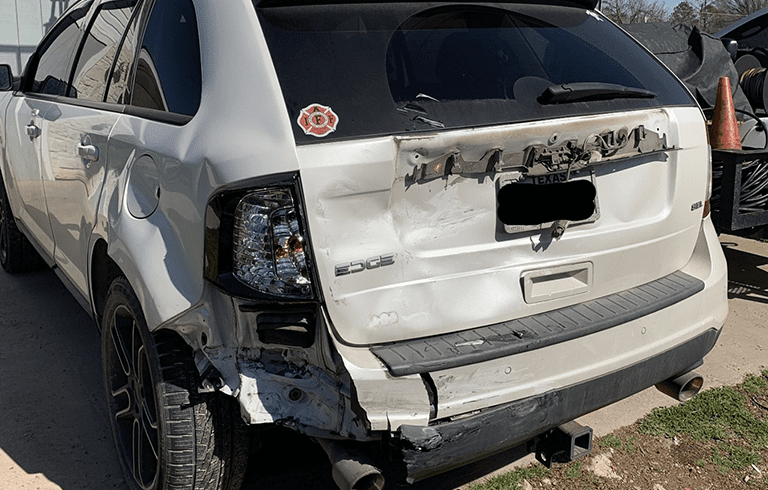

Injured in an Uber,Lyft or Ride-share Auto Accident? What you should know about Personal Injury in a Ride-sharing Accident

With the convenience of ride-sharing companies such as Uber and Lyft, more and more people are using these services as a primary means of transportation. These companies provide everything from periodic rides for special occasions, to day-to-day transportation for all kinds of people. There’s no doubt that the convenience of ordering a ride-sharing vehicle can be very attractive. But what happens when you’re involved in an auto accident?

Who is Liable for my Ride-share Accident?

You may have been riding as a passenger in an Uber, Lyft when an accident occurred. You may have been a pedestrian who was hit by one of these cars. Questions such as who is responsible, whose insurance applies, and how you will be compensated for injuries all become very important. It’s important to understand the basics of ridesharing law and how insurance will generally apply.

Just like any other driver on our roads, to become an Uber or Lyft driver, a person must carry and maintain their own insurance policy. So does this mean that the driver’s personal insurance coverage will apply to your damages? Usually, no. Uber and Lyft drivers are considered independent contractors, so in theory, that could allow the company to claim they are not responsible for accidents caused by these drivers. In fact, they often try and take this position. But this rarely works. In reality, these companies are profiting and benefiting from their drivers’ work, and are closely involved in monitoring that work. Generally, if you are involved in an accident, and your rideshare driver is at fault, the rideshare company is going to be held responsible for your damages and injuries. Both Uber and Lyft carry corporate liability policies which should cover medical bills, lost wages, pain & suffering, and non-injury damages. Even in many situations where your driver is not at fault, UIM (Un-insured or Under-insured Motorist policies) held by these ridesharing companies will compensate people who’ve been injured in an accident.

Collecting is Not always Easy

Because Uber and Lyft will often fight back, it’s important to hire an attorney that is proficient and specifically experienced in ridesharing accident injuries. Larger companies often try to avoid legal liability through specific rules and regulations, and it is important to have an attorney on your side who is knowledgeable in the law and willing to fight for you. Chandler |Ross has specific experience with ridesharing accidents, and will work relentlessly to get you everything you deserve.

What is Uber’s Insurance Policy?

Uber’s insurance policy ( https://www.uber.com/us/en/drive/insurance/ ) specifically dictates what coverage applies and when. If a driver has not yet paired with a passenger, but is online with the service, they are covered under the company’s insurance policy. Uber’s policy covers these “waiting” drivers with up to:

- $50,000 per person;

- $100,000 personal injury coverage per accident; and

- $25,000 property damage coverage per accident

So even when an Uber driver is not carrying a passenger, Uber’s policy may still apply when someone is injured. To the contrary, when a driver picks up a passenger (or is on the way to pick up a passenger), Uber’s policy coverage changes drastically. In this situation, the policy provides at least 1 million worth of coverage per accident.

What is Lyft’s Insurance Policy?

Lyft’s Insurance Policy is more complex. If a Lyft driver is online, but has yet to accept a ride, the driver’s personal insurance policy must first apply. If this insurance policy is not sufficient to cover damages and injuries, then Lyft’s corporate policy should take effect.

When a Lyft driver has accepted a ride (they are on the way to pick up a ride), or they have a passenger in the car, Lyft’s corporate policy of $1 million in liability coverage will take effect.

*** Remember, $1 million may sound like a lot, but if more than one person suffers serious injury, this amount can be severely inadequate. It is important to ensure that you have counsel knowledgeable to help you recover, especially when multiple parties are involved.

How can Chandler | Ross Injury Attorneys help me?

Many “gray areas” still exist in these kinds of accidents, and the specific facts of your case may not fall into one simple category. Issues of fault (liability) can be, and often are, challenged by ridesharing companies.

The Texas Injury Attorneys at Chandler | Ross can help you navigate the legalities of filing a proper claim, navigating the complexities of a potential settlement, and possibly filing suit if necessary. We have the knowledge and experience required to deal with the very specific legal issues pertaining to these types of cases. Whether you were a passenger or pedestrian, if you were injured by a ridesharing company, we are here to listen and here to help.

With offices in Denton, Dallas, and Fort Worth, Texas, Chandler | Ross, PLLC and our Personal Injury Attorneys are well positioned to provide the most effective and highly-skilled representation possible. Don’t wait, and don’t compromise – contact us today for a Free Case Evaluation and see how we can help you. In most cases, you pay nothing unless settle your case or win a verdict. Contact us now.